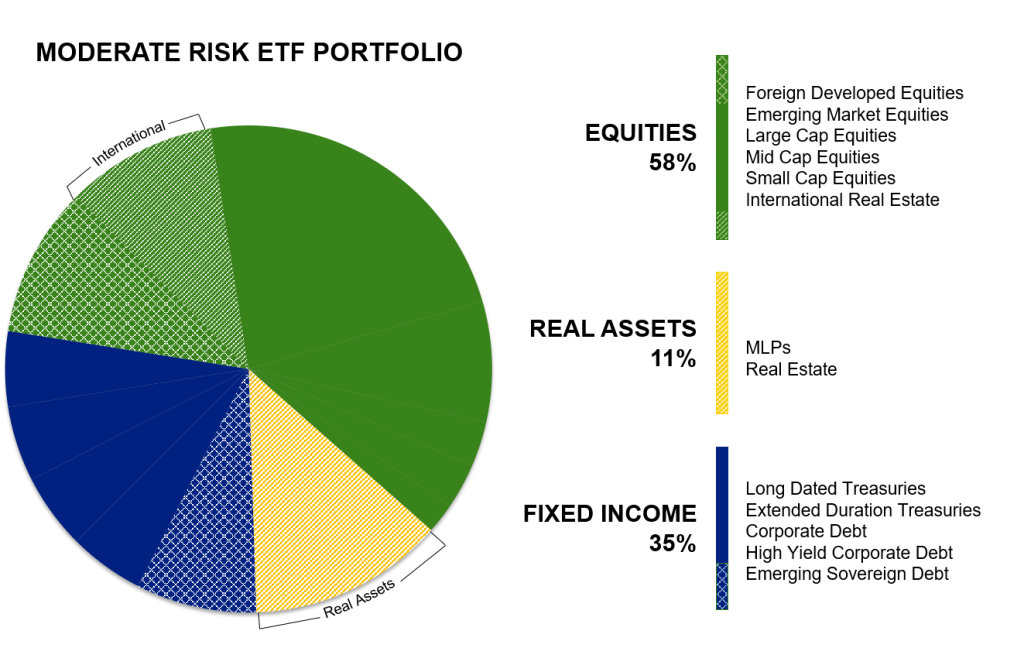

We have a number of highly diversified ETF portfolios that provide investors with exposure to equities, fixed income and real assets (e.g., real estate, pipelines, energy and gold).

Our portfolios include international and even emerging markets exposure but are tilted more towards the United States (given that most of our investors are in the US). Our ETF portfolios are balanced based on the investment objectives of a client, and can be more conservative (i.e., include more fixed income) or aggressive (i.e., include more equity) based on the time horizons, income needs and risk tolerance of the client. They are also periodically rebalanced to opportunistically underweight or overweight an asset class (e.g., equities) if we believe that it is undervalued (but always within a specific range, so as not to interject too much risk).